Johnson Reed now has access to the Coronavirus Business Interruption Loan Scheme (CBILS), enabling businesses that fit the criteria to apply for a government-backed loan to help support them through a difficult economic period. the loan is a available for an unknown amount of time and has various stages, requirements and processes that must be complete fully to ensure our panel of accredited lenders can process loan applications smoothly.

Our team have been working with businesses to ensure loans the process is smooth and loans can be cleared to protect jobs and help businesses to continue to trade, whether that is immediately or when safe to do so. Our lending panel requires specific information from businesses and business owners to ensure the application can be approved and the finances delivered.

Here is the full list of information to have ready for your CBILS application, including the preferred formats and styles, as specifically requested by lenders.

Last 2 years’ full accounts

Lenders require a full set of unabbreviated statutory year-end accounts for the past two years. These accounts must include full profit and loss summary, detailing income and expenses, giving the total amount of profit or loss over the accounting period. In addition, this must have a balance sheet signed by the director, which gives details of the company’s assets and liabilities at the end of the accounting period.

In addition, if the business involves selling goods, the accounts must involve statements of stock held by the company at the end of each financial year, all statements of stock takings from which you have taken or prepared any statements of stock and statements of all goods sold and purchased, other than by ordinary retail trade. This should list the goods, the buyers and sellers.

For more information on company accounts, visit: https://www.gov.uk/government/publications/life-of-a-company-annual-requirements/life-of-a-company-part-1-accounts

Last 9 months’ bank statements

Business bank statements for the last 9 months must be included, and must show the Account name and (where possible) the registered address. This information must match the business the loan application is created for. The statements must include the sort code and account number, all daily transactions, and a history of a minimum of six months, with the most recent being within one month of your CBILS application. These are available using online banking and are accepted in PDF format.

Details of all directors with shareholding of 25% or more

Companies will be required to give the name, date of birth and full home address of all directors with a shareholding of 25% or more for CBILS applications to be processed and considered. This must be full, accurate and up-to-date for lenders to determine if companies and company directors have been credit checked and are eligible for the scheme.

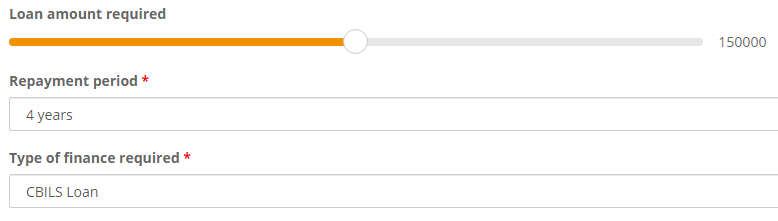

How much you want to borrow and repayment period

Terms are between £50,000 and £250,000 with Johnson Reed, you can select the amount on the application form. The approved amount will depend on the limit set by the lender based on the business, this will relate to turnover or salary bill. The first 12 months are payment free, meaning terms are between 24 months and 60 months (2 to 5 years), both of these options have an effect on repayment amount and may effect likelihood of a loan application being accepted.

For asset re-finance only: equipment description

For businesses seeking funds for asset re-finance, for heavy machinery, construction or engineering equipment, a description of these assets will be required. This is to include the age of the equipment, full model name, information on any upgrades or adjustments, any serial numbers, the original invoice or finance agreements.

As demonstrated, there is a lot of information to provide, however, this is essential to provide the lenders with a comprehensive and full view of your business, assessing the risk and security of the application. By making the lender’s job easier, applications are much more likely to be read and processed, therefore more likely to be accepted. By having and providing this information in the accepted and requested format, your application will be strong, giving your business the best chance to access the funding it needs.

For more information on the Coronavirus Business Interruption Loan Scheme or to speak to one of our team about your finance options, contact us at [email protected] or call 0161 429 6949.

Our online application form can be found here.

Download our PDF for more information.