On 3rd March 2021, Chancellor Rishi Sunak declared that the Coronavirus Business Interruption Loan Scheme (CBILS) would come to an end at the end of March, to be replaced with the Recovery Loan Scheme (RLS) from 6th April 2021, taking applications until 31st December 2021.

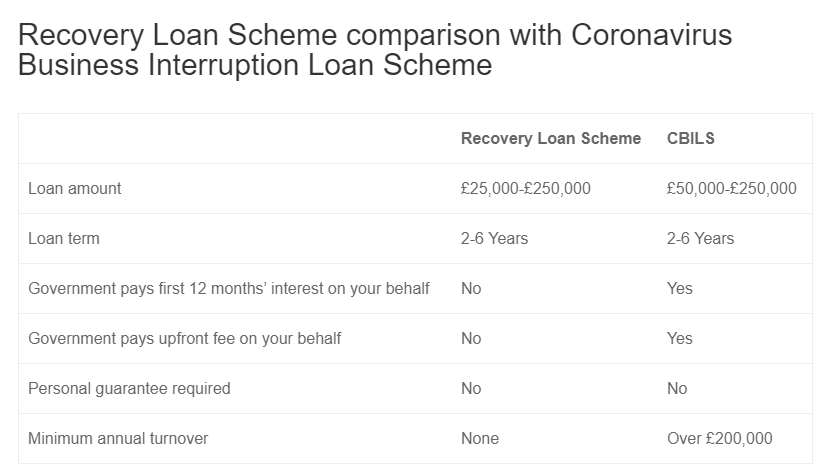

Having used the CBIL Scheme to support small and medium businesses in the past 12 months, there are some key differences between CBILS and RLS. To keep applicants updated with the finance options available to them and their business, we’ve highlighted the key differences and how that impacts your Recovery Loan or Finance.

Key Benefits of the Recovery Loan Scheme

No minimum turnover requirement

Unlike CBILS, there is no minimum turnover requirement for businesses applying for the Recovery Loan Scheme, making it an option for smaller or newer businesses that are financially viable, but don’t have a £200,000 annual turnover.

Range of loan amount

Businesses can lend from £25,000 to £250,000 with Johnson Reed, giving business owners flexibility to improve their cash flow and invest in their business with confidence.

No personal guarantee

As with CBILS, no personal guarantee is required, enabling business owners to secure finance for their business to support growth, improvement of services or manage cash flow, without the constraints of a personal guarantee.

If your business fits the criteria and you are interested in a Recovery Loan to finance, invest in or grow your business, visit our Recovery Loan Scheme page or contact us at 0161 429 6949 or [email protected].

CBILS and BBLS are managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy & Industrial Strategy. British Business Bank plc is a development bank wholly owned by HM Government. They are not authorised or regulated by the PRA or the FCA. Visit british-business-bank.co.uk